This was the deal at the House of Meats near our place:

- Yellow plantains for 59¢ each, or:

- 3 for $1.99

I got a better deal by buying 4.

This postcard appeared in our mailbox this morning — here’s the front…

…and here’s the back:

Note that there’s no postmark, which means that it was delivered by hand. How oddly and delightfully analog!

The link takes you to a simply but nicely designed page that makes the standard Bitcoin pitch that’s been around for years, with the usual talking points such as the expanding money supply and inflation, the fixed supply of Bitcoin, “it’s digital money and a computer network!”, and a couple of bits about how Bitcoin “isn’t volatile” and that “Bitcoin help stabilize the Texas energy grid through mining.” I’m not sure how that last one can possibly be true.

Later, just before 2:00 p.m., I got a text message from an unrecognized number: “When is your birthday?”

Just for kicks, I turned it into a conversation:

In case you were wondering, Nguyet Anh Duong is known in US defense circles as “The Bomb Lady” for her work on developing a thermobaric weapon.

Here’s the last bit of our conversation:

Blame my inner 14-year-old: the town name “Mianus” will always be funny to me.

This is most likely a “pig butchering” style scam. It takes its name from the fact that you fatten up a pig before killing it for its meat. The term comes from the land of delicious char siu pork, China, where it originated. It’s now practiced here in North America to great effect: recently, a woman who matched up with a scammer on Hinge ended up losing $300,000 and a man lost $1 million.

Sometimes it starts via a dating or social media app, but another common approach is the text from a stranger with an attractive profile picture. The initial text messages make it look like they’re texting a wrong number, and after some seemingly-embarrassed apologies, the scammer strikes up a conversation. Then, as they gain your confidence, they start steering you towards some kind of questionable online investment, preferably one that makes the money hard to track once it’s gone.

Chances are that whoever’s supervising the texter playing “Tina” saw my responses and said “Stop wasting your time; this guy’s just yanking your chain,” which is exactly the case.

There’s an episode of the Jordan Harbinger Show on the topic of pig butchering — you can either listen to it or watch it below:

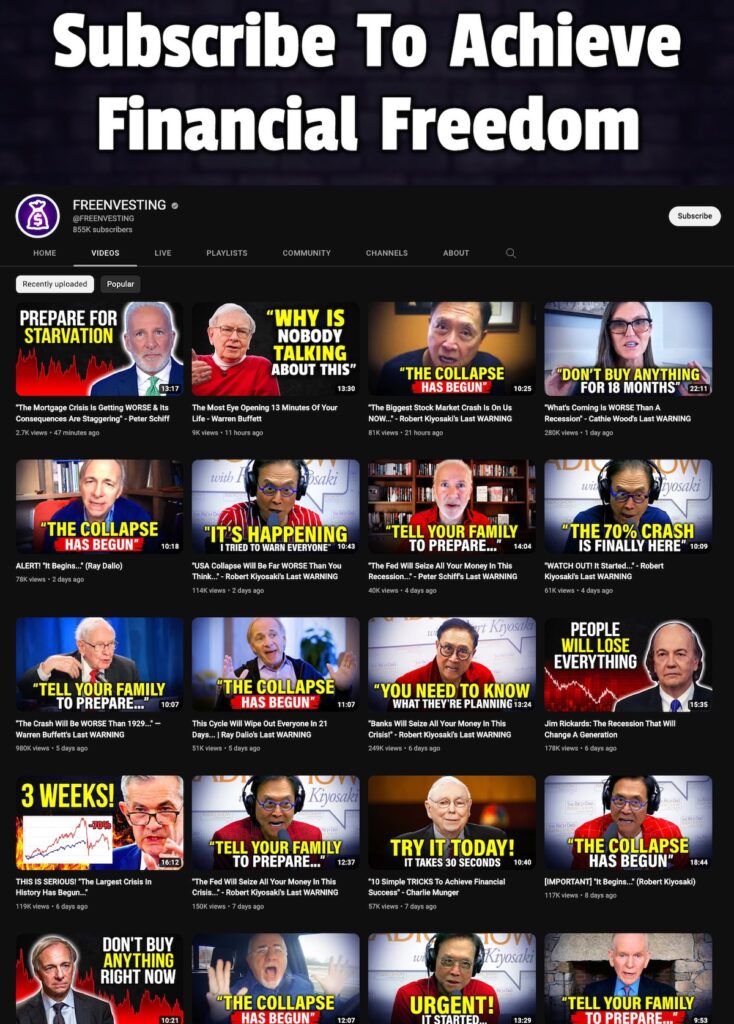

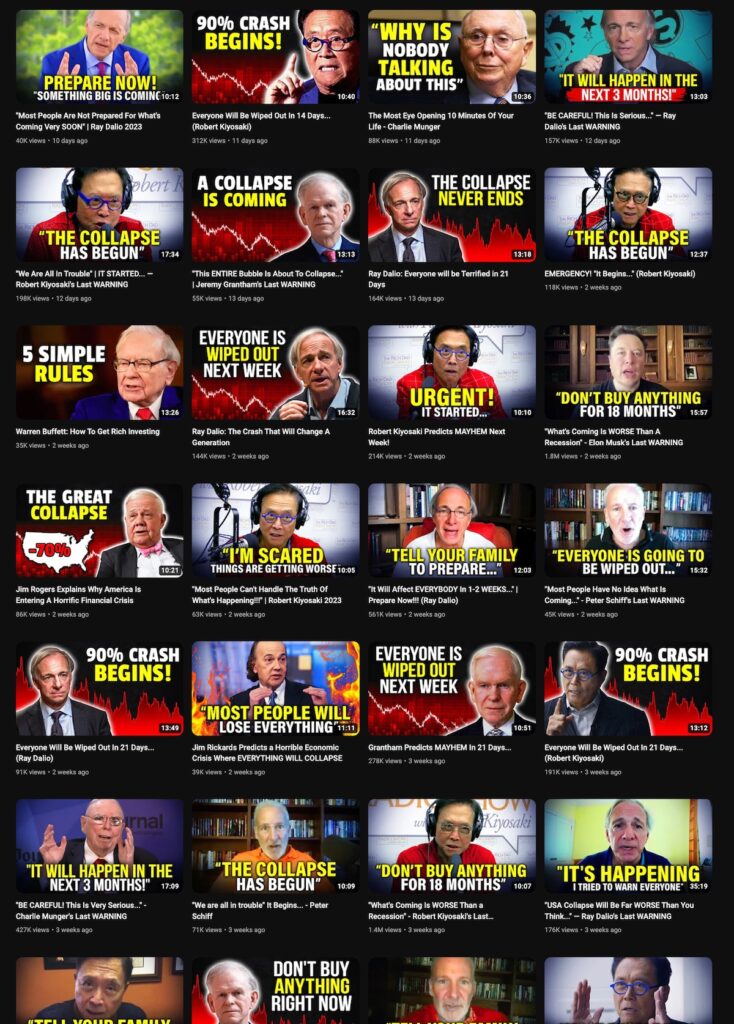

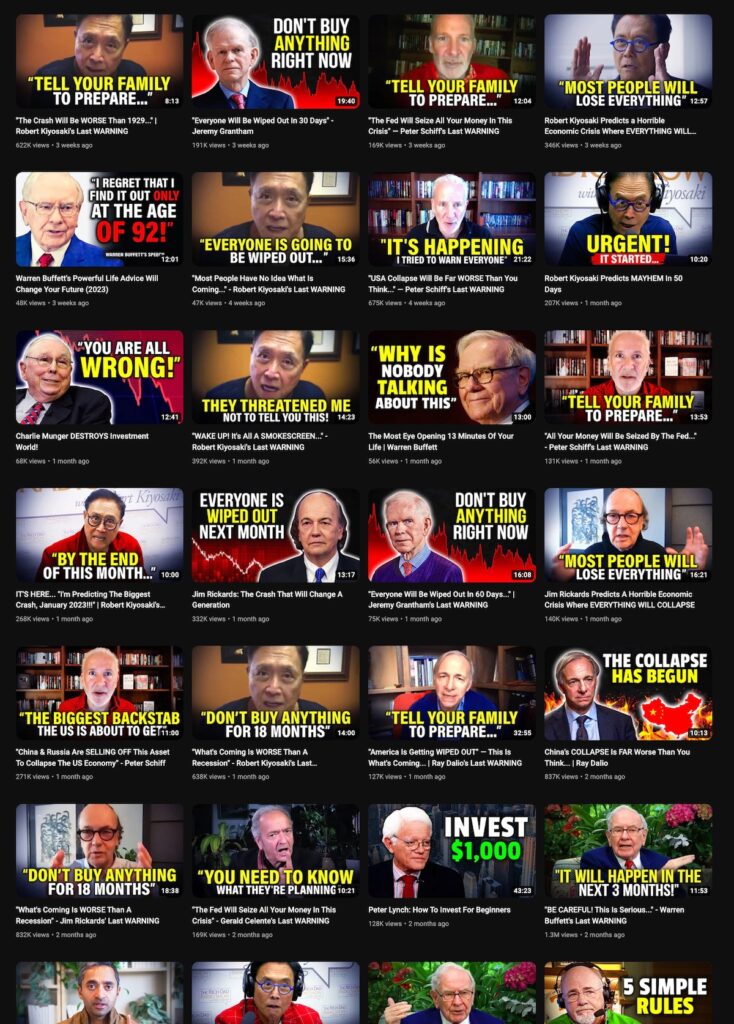

If you visit YouTube but don’t sign in, its suggested videos are based on best guesses based on trends, your location, your recent browsing history and a few other factors. I do this from time to time to see what sort of things YouTube’s recommendation algorithm serves up.

Last night, it suggested videos from the FREENVESTING channel (and no, I’m not linking to those jackals), which simply describes itself as “An inspiring channel for those who are seeking growth.” Established on September 1, 2020, it’s accumulated nearly 100 million views to date, and it appears to have done so by harnessing the fear of financial doomscrollers.

The videos feature financial gurus of varying quality. Some are more respectable, such as Warren Buffett and Charlie Munger. Some are semi-respectable: Ray Dalio and Cathie Wood. And then there are the outright assclowns — I’m lookin’ at you, Robert Kiyosaki and Dave Ramsey.

The videos may change, but the themes and titles on the thumbnails stay the same:

The channel was a little more “tips and tricks from the rich” in the beginning…

…and they certainly covered all the angles, as you can see from these two contradictory videos, which were released one after the other:

But like any good YouTuber, they did some experimenting and found a winning formula with this gem from Mr. “Rich Shill, Poor Audience”:

…and it’s been doom-a-rama ever since.

You’d think it might be enough to say “watch this channel, but only to recognize hucksters when you see them,” or to learn some tricks if you’re an aspiring YouTuber, but I recommend doing so very sparingly. This sort of fear-based stuff has a way of getting in your head, even if you’re trying to watch it objectively and from a distance.

I remember hearing The Three Laws of Money from OpenCola’s cofounder John Henson when I worked there — 2000 through 2002 — during those high-flying days at the end of the dot-com bubble. He said he heard it from someone else, but I can’t remember whom.

In light of everything that’s happened with cryptocurrency this year, I thought I’d post this and remind everyone of rule three.

Once again, the Three Laws of Money are:

First, there was the Spirit Venture Capitalist costume, and now there’s this one: “Freelance Recruiter Who Ghosted You.” I see more of these coming.

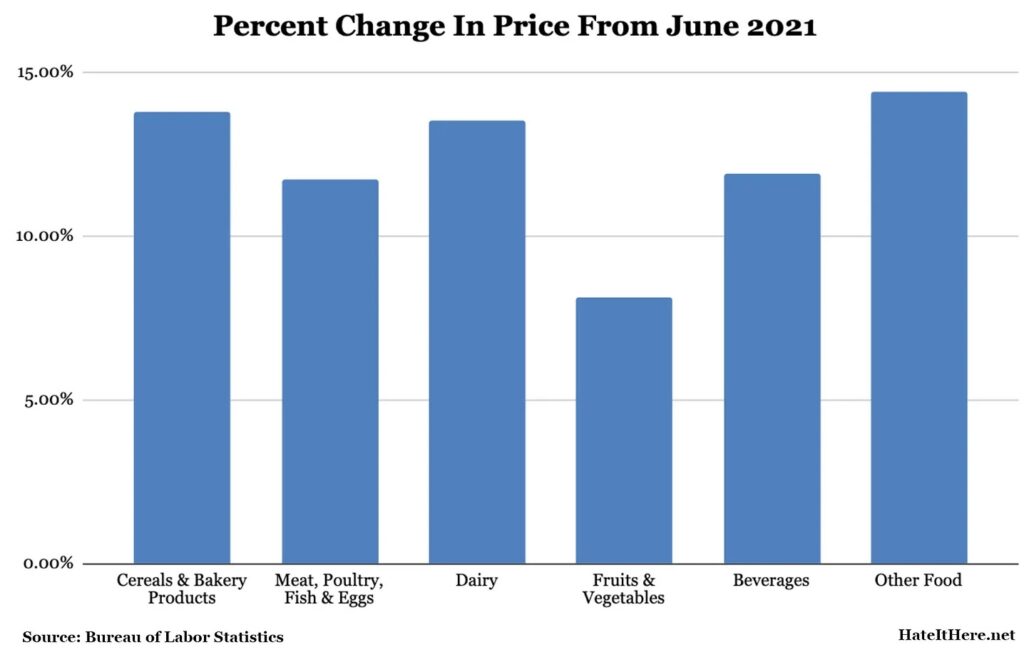

Some noteworthy facts from a recent post in Jordan Uhl’s newsletter, I Hate It Here And Never Want To Leave:

…has created 62 new “food billionaires” in the past two years. If you combine the energy-for-biologicals industry (food) with the energy-for-machines industry (what we call “energy”), they’ve grown their fortune by nearly half a trillion dollars in the past two years.

…has created 62 new “food billionaires” in the past two years. If you combine the energy-for-biologicals industry (food) with the energy-for-machines industry (what we call “energy”), they’ve grown their fortune by nearly half a trillion dollars in the past two years.At the same time, you’ve got the hue and cry from the executive class, with that same old “nobody wants to work” refrain. It’s nothing new, and suggests that the current situation isn’t a labor shortage, but a wages and worker treatment shortage: