Some noteworthy facts from a recent post in Jordan Uhl’s newsletter, I Hate It Here And Never Want To Leave:

- I’ll open with a direct quote from the newsletter: 75% of middle-income families say their wages are falling behind inflation, according to a new report from Primerica and Change Research. 77% say they’re expecting and preparing for a recession, with 71% already cutting back on spending to help make ends meet.

- Corporate profits are at 70-year record highs. Since 2020, the after-tax profits made by corporations who aren’t in the business of finance have grown by a trillion dollars:

Tap to view at full size. You can also see this graph at its source. - There was a record level of stock buybacks: $882 billion! A stock buyback is the act of a publicly traded company (one that issues stock to the public) using cash to buy its own stock on the open market. This reduces the supply of the company’s available stock, raising its price, which is what shareholders like.

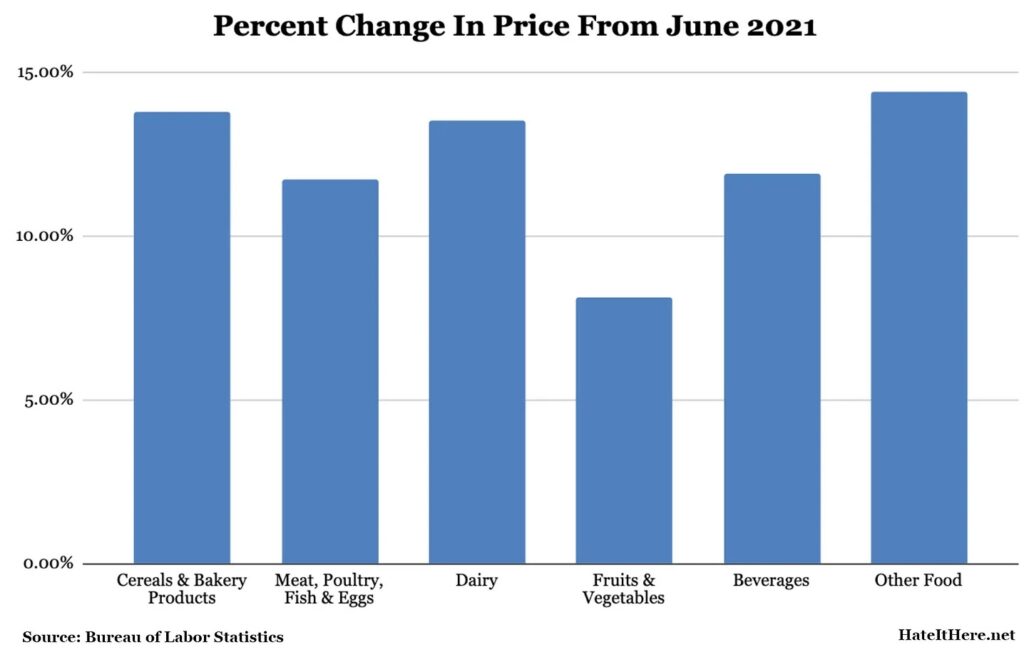

- The rise in global food prices…

…has created 62 new “food billionaires” in the past two years. If you combine the energy-for-biologicals industry (food) with the energy-for-machines industry (what we call “energy”), they’ve grown their fortune by nearly half a trillion dollars in the past two years.

…has created 62 new “food billionaires” in the past two years. If you combine the energy-for-biologicals industry (food) with the energy-for-machines industry (what we call “energy”), they’ve grown their fortune by nearly half a trillion dollars in the past two years. - I’ll close with another direct quote from the newsletter: “The average S&P 500 CEO received $18.3 million in total compensation in 2021, an increase of 18% in one year. During that same period, average hourly earnings for workers fell 2.4%.”

At the same time, you’ve got the hue and cry from the executive class, with that same old “nobody wants to work” refrain. It’s nothing new, and suggests that the current situation isn’t a labor shortage, but a wages and worker treatment shortage:

One reply on “Someone’s sitting pretty in this economy”

The buybacks are driven in part by US tax law. Dividends represent profits that have been taxed in the company’s hands. In the US, they’re again taxed as income in the shareholder’s hands – ie the profit is taxed twice. However, buying back the shares only incurs tax once – the capital gain in the shareholder’s hands.