Welcome to the eighth article in the Spring Cleaning series, where I take articles that have languished unfinished for too long, finish them, and finally post them here on the Accordion Guy blog. In case you missed any of the previous seven, I’ve listed them below:

Welcome to the eighth article in the Spring Cleaning series, where I take articles that have languished unfinished for too long, finish them, and finally post them here on the Accordion Guy blog. In case you missed any of the previous seven, I’ve listed them below:

- Burgers. Burgers everywhere.

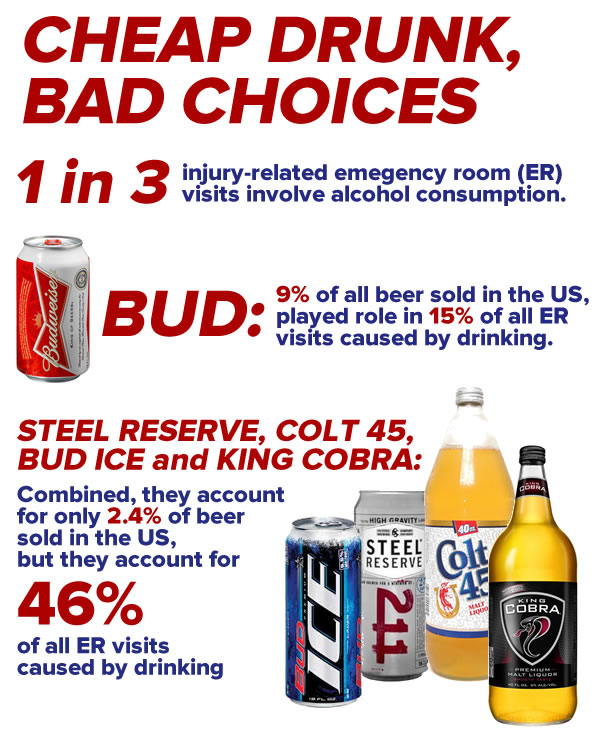

- Which beer is most likely to land you in the emergency room?

- Weber Cooks, the saddest cooking show

- Get on your bicycle!

- Fireworks and sensitive body parts

- Work!

- Storytelling, “Save the Cat”, and same-old-same-old in Hollywood

In this installment, I look at financial advice…

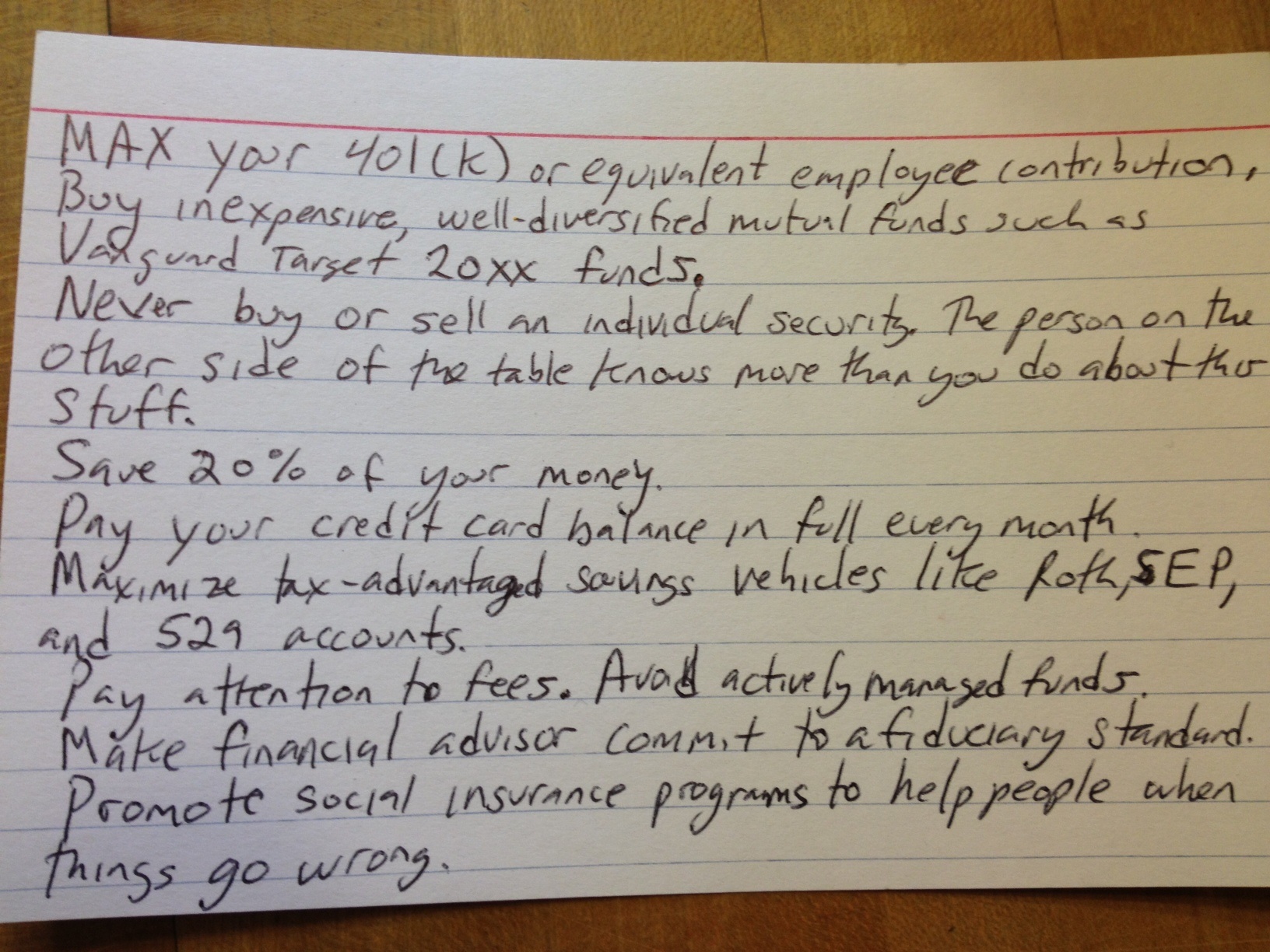

The 4-by-6 card that has the best financial advice

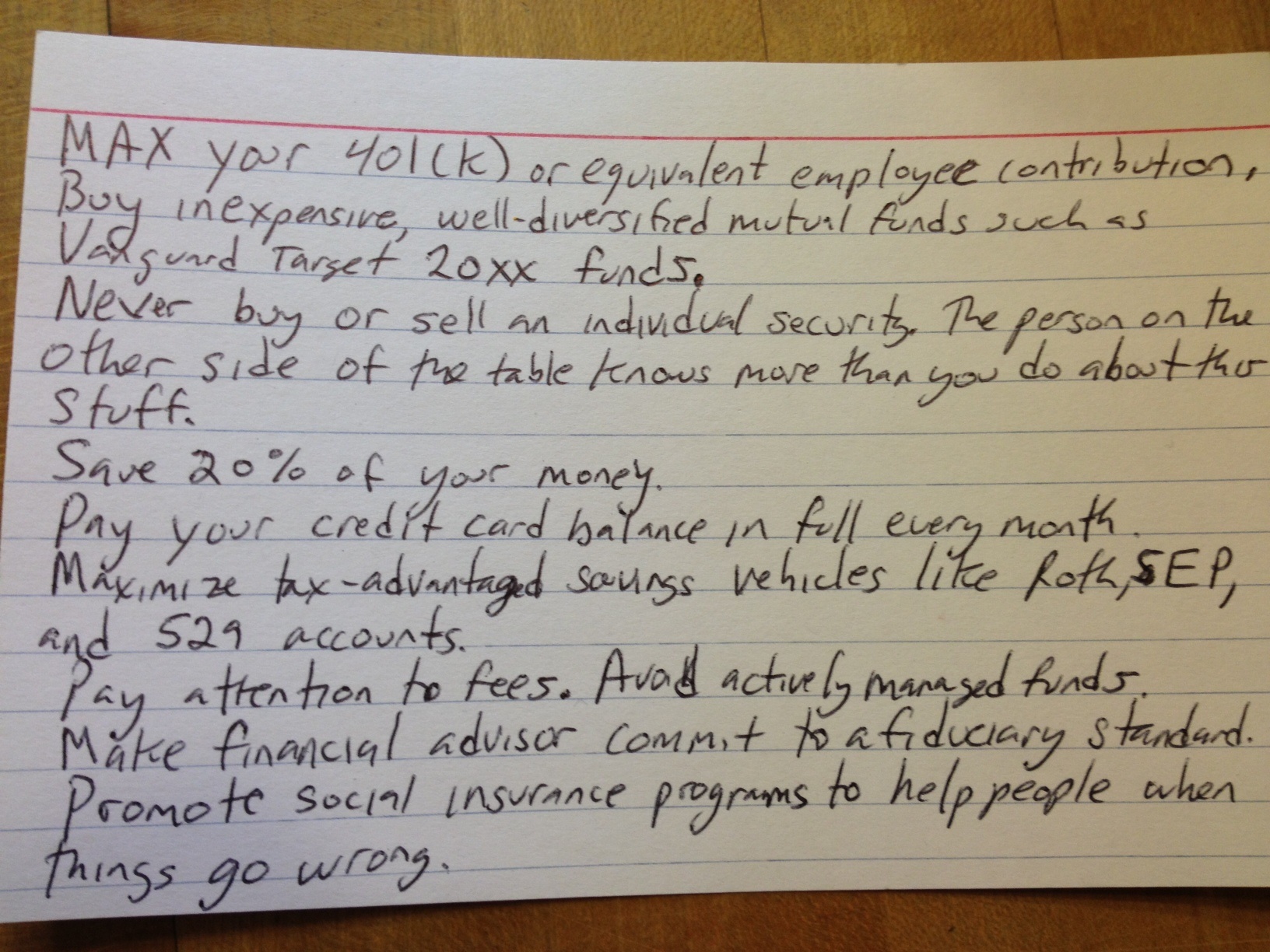

The 4-by-6 card with all the financial advice you’ll ever need.

Click the photo to see it at full size.

On financial matters, Harold Pollack of the blog The Reality-Based Community says that the best advice fits on an index card. After having a conversation with Helaine Olen, author of the book Pound Foolish: Exposing the Dark Side of the Personal Finance Industry, he took her advice and summarized it on a 4-by-6-inch index card, pictured above. The text of the card reads as follows:

- Max your 401(k) or equivalent employee contribution. (In Canada, the closest analogue is the RRSP; see this quick summary on the MoneySmarts blog for the similarities and differences between 401(k)s and RRSPs.)

- Buy inexpensive, well-diversified mutual funds such as Vanguard Target 20xx funds.

- Never buy or sell an individual security. The person on the other side of the table knows more than you do about this stuff.

- Save 20% of your money.

- Pay your credit card in balance in full every month.

- Maximize tax-advantaged savings vehicles like Roth, SEP, and 529 accounts.

- Pay attention to fees. Avoid actively-managed funds.

- Make financial advisor commit to a fiduciary standard.

- Promote social insurance programs to help people when things go wrong.

Pound Foolish by Helaine Olen

Pound Foolish is Helaine Olen’s look into the “myths, contradictions, and outright lies” that have been perpetuated by the personal finance industry, which started as a response to the Great Depression and has since grown to become a juggernaut that sells the illusion of financial security but provides little in the way of actual help. In Pound Foolish, Olen says that there are many myths about spending and saving, including these ones, which I’ve taken from the book’s site:

Pound Foolish is Helaine Olen’s look into the “myths, contradictions, and outright lies” that have been perpetuated by the personal finance industry, which started as a response to the Great Depression and has since grown to become a juggernaut that sells the illusion of financial security but provides little in the way of actual help. In Pound Foolish, Olen says that there are many myths about spending and saving, including these ones, which I’ve taken from the book’s site:

- Small pleasures can bankrupt you: Gurus popularized the idea that cutting out lattes and other small expenditures could make us millionaires. But reducing our caffeine consumption will not offset our biggest expenses: housing, education, health care, and retirement.

- Disciplined investing will make you rich: Gurus also love to show how steady investing can turn modest savings into a huge nest egg at retirement. But these calculations assume a healthy market and a lifetime without any setbacks—two conditions that have no connection to the real world.

- Women need extra help managing money: Product pushers often target women, whose alleged financial ignorance supposedly leaves them especially at risk. In reality, women and men are both terrible at handling finances.

- Financial literacy classes will prevent future economic crises: Experts like to claim mandatory sessions on personal finance in school will cure many of our money ills. Not only is there little evidence this is true, the entire movement is largely funded and promoted by the financial services sector.

“Most of the financial advice published and dished out by the truckload is useless,” Olen writes, saying that it’s “oblivious to the messiness of the human condition.”

A former personal financial columnist for the Los Angeles Times herself, she says that most advice fails to factor in matters such as job loss, long bouts of unemployment (who are often caught in a vicious circle because employers don’t want to hire long-term unemployed), medical bankruptcy (which accounts for the majority of personal bankruptcies in the US), and high-interest debt. Many employers think of employees purely as costs…

…and believe that it’s a law of capitalism to pay their employees as little as possible. When people manage to save, their savings gets outclassed by the stagnation or drop in housing prices and interest rates, and other economic events well beyond their control. Even the good advice that comes out means little when you have little savings.

At the same time, the issue of staying afloat financially is seen in the hyper-individualistic culture of America as a problem one could deal with on one’s own rather than as a social problem. The quip commonly attributed to Steinbeck seems quite true: the American poor don’t see themselves as an exploited proletariat, but as temporarily embarrassed millionaires, which is why you end up with fake “heroes” like “Joe the Plumber”, who is neither named Joe more a licensed plumber, but is a staunch defender of tax cuts for the rich. This has created an industry of snake oil that feeds off people’s fear, especially as people approach retirement age; in 2009, the AARP found that one in ten people over 55 had attended a “free financial seminar” in the past three years.

Talking with Helaine Olen

Harold Pollack, who created the 4-by-6 index card above, talked to Olen in a two-part interview. In the first part, shown below, they discuss topics such as:

- How she became a personal finance columnist,

- Why divorce is bad for your financial health,

- Why trusting financial advisors is generally a bad idea, even if your advisor is above ethical reproach,

- The false hopes placed in personal financial skills to offset stagnant wages for millions of Americans,

- That Suze Orman isn’t one of the world’s greatest financial advisors, but has found one of the world’s greatest sales gigs:

In the second part, shown below, they go on to cover things like those dinners where hucksters sell rip-off variable annuities to seniors afraid of outliving their savings. According to Pollack, “these salespeople predictably trash Social Security—the one solid source of annuitized wealth Americans can turn to in their retirement years”:

If you’d like to hear more about the ideas in Pound Foolish, here’s an hour-long presentation featuring Olen talking about the ideas in her book at a gathering put together by The New America Foundation’s Asset Building Program:

This is the tenth article in the Spring Cleaning series, where I take articles that have languished unfinished for too long, finish them, and finally post them here on the Accordion Guy blog. In case you missed any of the previous nine, I’ve listed them below:

This is the tenth article in the Spring Cleaning series, where I take articles that have languished unfinished for too long, finish them, and finally post them here on the Accordion Guy blog. In case you missed any of the previous nine, I’ve listed them below: