Squeaking By on $300,000: even in fat times, the headline of that article, which appeared in Sunday’s Washington Post, is far too tantalizing to ignore. What sort of person “squeaks by” on three hundred large?

One such person is Laura Steins, whose life – especially the socio-financial bits – is the subject of the article. She is a a vice president at MasterCard and lives in Birch Hill, a wealthy suburb outside New York City, and a divorcee with the custody of her three children.

I read the article and the the commentary about it on the web about the article and have written my thoughts below.

The Situation

She and her family live in a 4,000 square foot house valued at US$2.5 million; after the divorce, she bought out her husband’s half. The picture below shows both its exterior and interior:

The article’s opening paragraphs flesh out her situation a little more:

"Morning," says Laura Steins, 47, wearing a dark Armani suit and take-charge heels. Her blue eyes are lustrous and her skin is golden, and even with wet hair and no makeup, she radiates confidence.

But she’s months overdue for a visit to her colorist, a telltale sign of economic distress for a woman such as Steins. The smell in the basement could mean a crack in the septic line; unlike a $200 hair appointment, a plumber will be in the thousands. And from the breakfast table comes one more urgent need from a 10-year-old.

"At my birthday party, every single girl had a phone," says Katie Steins, making the case that an enV2 phone with matching cover is just standard in her crowd.

Steins kneels down to face her daughter. "If you continue to tell the world how undesirable your phone is — it’s not a flip, it’s not a swivel, it’s not an LG — you will not have a phone."

Steins takes a breath. Life in this $2.5 million house was built on the premise of two incomes, not the income of a divorced mother of three in a tanked economy. Her property taxes are $35,000 a year, the nanny is $40,000 and the gardener is $500 a month.

"I can ride this storm out," says Steins, which means having tiger-striped hair and getting her kid a generic cellphone and ignoring the stinking basement.

Follow the Money

Although Steins probably considers herself to be part of the middle class – perhaps upper middle class, but middle nonetheless — her circumstances put her farther ahead in the game than most people in her situation. Consider her sources of income, which the article lists as:

| Source of Income |

Amount (US$) |

| Salary |

$150,000, plus bonus. She’s taking home 10% less this year because bonuses were downsized. |

| Child support from the ex-husband |

$75,000 |

| Money from a personal investment account to “pick up the slack” |

$50,000 |

| Total |

$275,000 |

At $275,000, she’s making 5.5 times the 2007 median U.S. family income (according to Wikipedia’s page on median household income) and almost 7.5 times the 2007 median income for a family run by a single woman (according to this article in the Washington Area Women’s Foundation blog). It’s almost $100,000 more than the lower limit of the top 5% of U.S. household incomes for 2007.

As far as assets go, Steins has a treasure trove compared to most of us. She doesn’t just have a house on a nice lot in a tony neighbourhood, but all the accoutrements: furniture, appliances, electronics, clothes and so on. On the more liquid side, there’s her personal investment account. If it’s providing $50,000 to “pick up the slack” (her words, as quoted in the article) this year, I have to ask:

- What companies is this account investing in?

- If $50,000 is this year’s payoff, what’s the principal?

You Can’t Go Back

It’s easy for us to ask why Steins doesn’t sell her house. She explains that she doesn’t want to uproot the kids and that it’s near her work. There’s also the issue of the current economic climate: it’s hard to sell a house right now, especially one worth $2.5 million.

Her explanations, while reasonable, sound like rationalizations. As Chris Rock put it in one of his stand-up routines (in a very funny, very vulgar way which I’ll leave you to discover for yourself): once you get used to a certain lifestyle, it’s hard to go back. It’s a fair bet that when she was still with her husband, the household income was closer to a half million per annum.

Steins may also be holding on to her lifestyle, and especially the house, as a source of comfort in the wake of her divorce. In times of overwhelming, unpleasant change, we look for comfort in the familiar, and what’s more comforting and familiar than home?

Keeping Up Appearances

Keeping up appearances is also a factor. There’s a couple of telling anecdotes in the article, the first of which is Steins’ daughter complaining about her mobile phone wasn’t an LG enV2 — a model name so appropriate for the article that it’s downright Dickensian – which is the standard phone among her friends.

The other notable story about the importance of appearances is about a theme party in Steins’ neighbourhood. Its theme was the recession, the food and drink came from Costco, and guests were asked to dress down in old clothes and bring something non-perishable to be donated to the food bank. One guest violates the rules and shows up wearing a blazer and khakis, explaining that he wanted to show up in jeans but his wife wouldn’t let him. “They were so vintage,” she says by way of explanation, “I couldn’t bear it.”

Funny Because It’s True

There’s a quote in the article that made me laugh out loud. It comes from Kathy Shellogg, Steins’ live-in nanny, who in describing the Steins’ food preferences, says “They are big mayonnaise people.”

Violating the Unwritten Rule

Steins is breaking the rule that you learn by osmosis if your parents are professionals and have at one time or another owned a Swedish automobile or a sailing vessel at least 20 feet long: You should appear in the newspaper three times at most – your birth announcement, your wedding announcement and your obituary.

I wonder what she was thinking when consented to be covered in this story.

Wife 2.0

One of the photos in the gallery accompanying the article shows Steins with her daughter Katie, her ex-husband and her ex-husband’s new wife. Wife 1.0 and Wife 2.0 look eerily similar, right down to the way they dress:

Rorschach Test

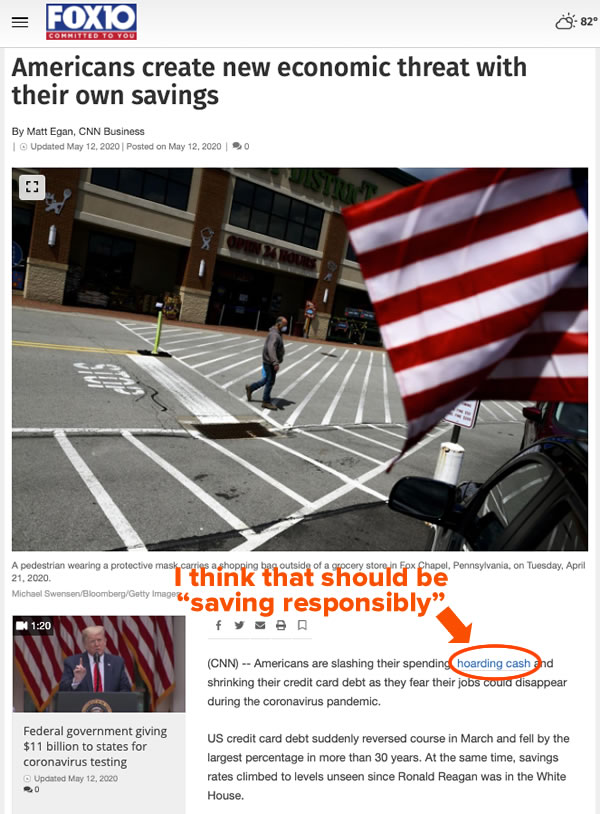

The article makes a pretty good socio-political Rorschach test. People from different points on the political spectrum reacted to the article differently.

The article makes a pretty good socio-political Rorschach test. People from different points on the political spectrum reacted to the article differently.

There were over 1,000 comments made directly to the article. Most of the commenters seem to have trouble feeling sorry for Steins, and some asked why the article even made it past editorial.

On sites like OpenLeft, there’s not much sympathy for Steins either; author David Sirota considers the article part of a larger stealth marketing campaign “designed to make us believe that very wealthy people are suffering the most”. A commenter on Brazen Careerist went so far as to question the wisdom of having three children: “That’s expensive and not necessarily ideal, on the kids or the parents, or society.”

Meanwhile, “Freepers” – participants on the right-wing Free Republic message boards – tend see the article as a ham-handed attempt by the Washington Post, part of that cabal known as the Liberal Media, to engender class envy and foment class warfare. Some of them wondered if she or her ex-husband were benefiting from TARP money (they apparently don’t), most praised her for having a good job, a couple said that their employees don’t make as much money as Steins’ nanny and a few wondered if she voted for Obama, being one of them no-good east coast lib’ruls.

The one thing shared by commenters on both ends of the political spectrum was the statement that they could squeak by on far, far less. Since Steins’ income is certainly in the top 5% and likely even in the top 3%, that’s probably true.

The article makes a pretty good socio-political

The article makes a pretty good socio-political