Tag: Credit Crunch

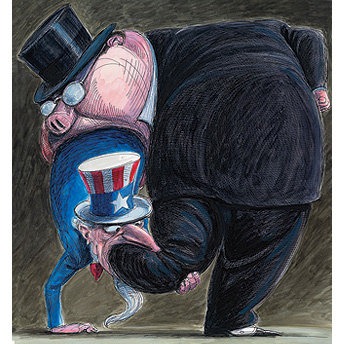

“The Big Takeover”

The Big Takeover (here’s the regular version, and here’s the single-page “printer-friendly” version) is a Rolling Stone article that suggests that the global economic crisis isn’t about money, but power, and that Wall Street insiders are using the bailout as fuel for an all-out move to take over. Here’s an excerpt from the end of the article:

As complex as all the finances are, the politics aren’t hard to follow. By creating an urgent crisis that can only be solved by those fluent in a language too complex for ordinary people to understand, the Wall Street crowd has turned the vast majority of Americans into non-participants in their own political future. There is a reason it used to be a crime in the Confederate states to teach a slave to read: Literacy is power. In the age of the CDS and CDO, most of us are financial illiterates. By making an already too-complex economy even more complex, Wall Street has used the crisis to effect a historic, revolutionary change in our political system — transforming a democracy into a two-tiered state, one with plugged-in financial bureaucrats above and clueless customers below.

The most galling thing about this financial crisis is that so many Wall Street types think they actually deserve not only their huge bonuses and lavish lifestyles but the awesome political power their own mistakes have left them in possession of. When challenged, they talk about how hard they work, the 90-hour weeks, the stress, the failed marriages, the hemorrhoids and gallstones they all get before they hit 40.

"But wait a minute," you say to them. "No one ever asked you to stay up all night eight days a week trying to get filthy rich shorting what’s left of the American auto industry or selling $600 billion in toxic, irredeemable mortgages to ex-strippers on work release and Taco Bell clerks. Actually, come to think of it, why are we even giving taxpayer money to you people? Why are we not throwing your ass in jail instead?"

Help Daniela!

Pictured above are Daniela and her three children: Daniela (age 9), Brandon (age 6) and Evelyn (age 4). Daniela and her family are in a difficult situation, and David Armano (VP Experience Design at Critical Mass, a Chicago-based marketing and design agency) is trying to rally some help for her.

Daniela is a Romanian immigrant who divorced her husband after years of physical abuse. Her youngest daughter Evelyn has Down Syndrome. She makes very little money cleaning houses and lost her house when her mortgage went unpaid.

David and his family have taken Daniela and her family into their home. They’re trying to get her an apartment through a fundraising drive. The goal is to collect at least US$5,000 so that she doesn’t have to worry about rent or a deposit while trying to improve her situation.

Here’s a photo taken inside David’s garage that shows everything that Daniela owns in the world:

David wrote in his blog post about about Daniela that he understand that getting donations in these tough economic times is difficult. In spite of that, he’s asking people to make donate even just a little money to help Daniela out.

I would argue that in times like this, it’s even more important to make an effort to perform acts of kindness. Pulling together and helping each other, especially those of us who are most vulnerable, is how we’ll all ride out the Credit Crunch. As Douglas Rushkoff wrote in his essay Riding Out the Credit Collapse:

The more we are willing to do for each other on our own terms and for compensation that doesn’t necessarily involve the until-recently-almighty dollar, the less vulnerable we are to the movements of markets that, quite frankly, have nothing to do with us.

As of my writing this, David’s campaign has raised over $9,000 for Daniela. Even though he’s raised nearly twice the target amount for Daniela, I would still suggest that you make a donation if you can. $5,000 isn’t going to last very long, and with three kids, Daniela will have expenses other than rent to worry about.

To make a donation to Daniela’s fund, click here to see David Armano’s blog article.

[Thanks to Jay Goldman, whose Twitter message led me to David Armano’s blog.]